Schneider Electric (SBGSY): Company Profile, Stock Price, News, Rankings

€ 28.00 · 4.8 (425) · En stock

Por un escritor de hombre misterioso

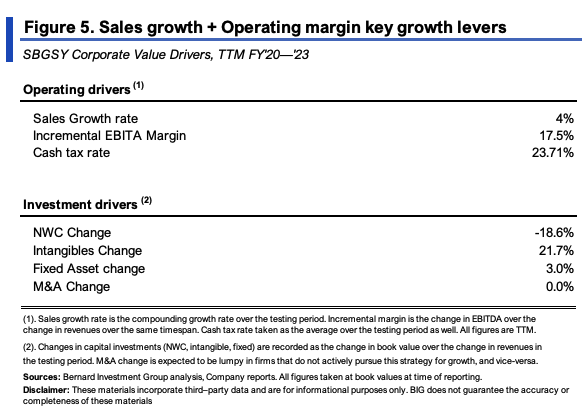

French multinational Schneider Electric supplies products and services for industrial automation and energy management. Revenues rose to a record $35.9 billion in 2022, as Schneider worked to clear a backlog of orders built up during COVID-19, while profits fell 3.5% to $3.7 billion.

- Schneider enjoyed its highest revenue growth in North America, driven by its residential and data center offerings.

- In February, the company bid farewell to CEO Jean-Pascal Tricoire after two decades at the helm. Tricoire handed the reins to Peter Herweck, Schneider’s head of industrial automation and the former boss of U.K. engineering software company Aveva.

- Schneider completed the acquisition of the 40% of Aveva it didn’t already own in January 2023, for £3.9 billion ($4.8 billion). Schneider’s strategy is to increase the role of software, services and the Internet-of-Things in its sales mix, and to respond to the twin trends of electrification and digitization.

Top 10 Stocks Set to Gain From Global Megatrends: Fund Manager

EnerSys (NYSE:ENS), Air Products (NYSE:APD) and Emerson Electric (NYSE:EMR): Making Money from the Conversion to Green Energy - The Wall Street Transcript

Schneider Electric: An Excellent, Global Energy Solutions Company

Sanet ST BarronsFebruary272023, PDF, Stock Market Index

Schneider Electric SE Share Price Today

Rexnord (RXN) Beats Q1 Earnings, Sales, Maintains FY18 View

DD] General Electric (GE) : r/StockMarket

Schneider Electric (SBGSY) Investor Presentation - Slideshow (OTCMKTS:SBGSY)

SBGSY: Schneider Electric SE Stock Price Quote - OTC US - Bloomberg

Schneider Electric: Dividends Well Supported By Economic Performance, Rate Buy (SBGSF)

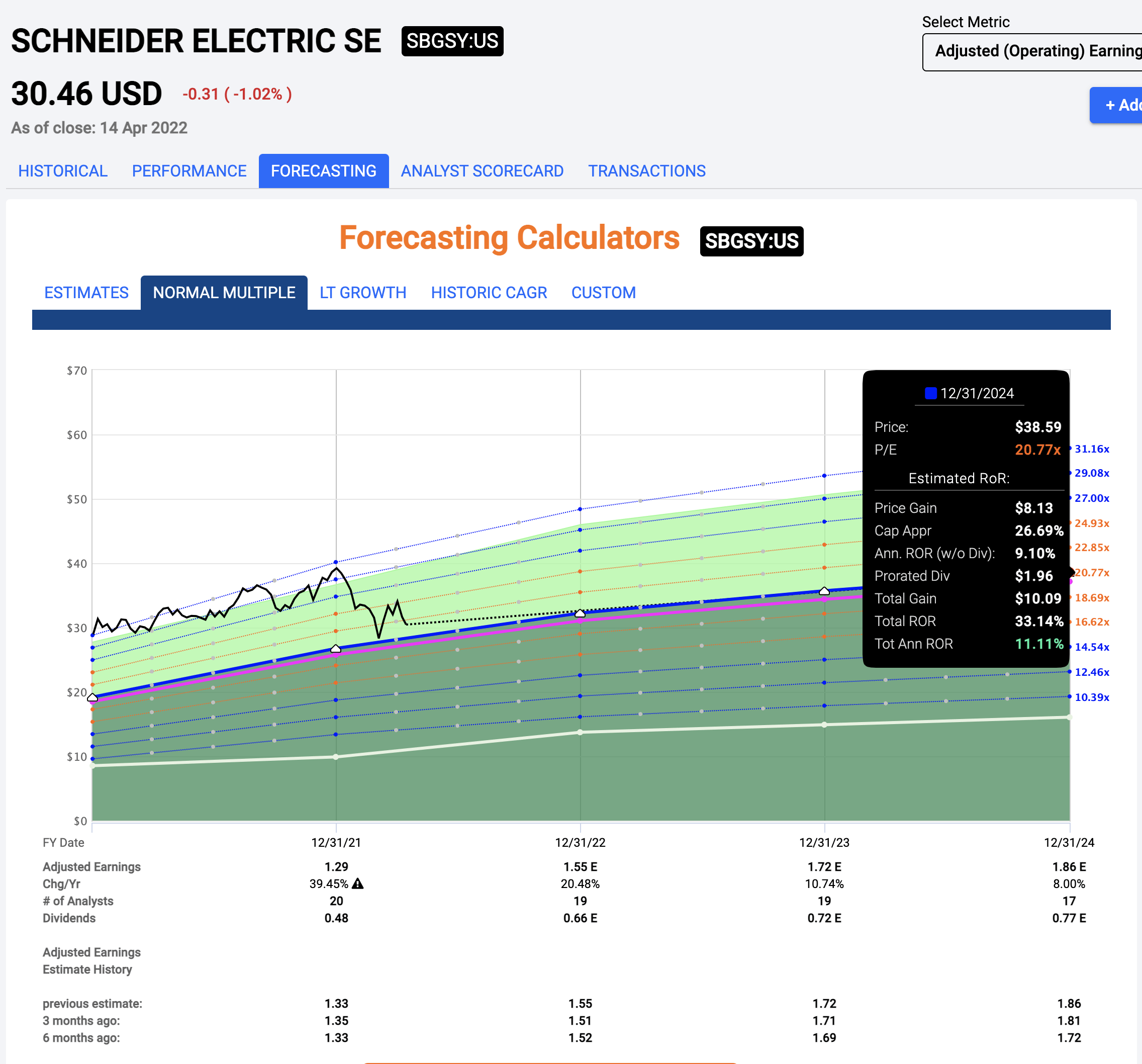

SBGSY Stock Price Forecast. Should You Buy SBGSY?

SBGSY - Schneider Electric S.E. - Depositary Receipt (Common Stock) Stock - Stock Price, Institutional Ownership, Shareholders (OTCPK)